Futures proprietary trading firms are companies that allow traders to trade futures contracts using the firm’s capital rather than their own. These firms typically evaluate traders through structured challenges or performance criteria, after which successful participants gain access to funded accounts. Among others in space, Blueberry Futures is a futures trading and proprietary trading platform designed to provide traders with access to global futures markets and professional funding opportunities. Read on this Blueberry Futures Review to know more about it as a futures proprietary trading firms.

What is Blueberry Futures?

Blueberry Futures positions itself as a proprietary futures trading evaluation and funding platform designed to enable skilled traders to access professional capital through structured evaluation challenges. The official site frames the service as a pathway from demonstrated trading performance in a simulated environment to managing substantial real trading capital, with profit‑sharing incentives and progressive account scaling.

At its core, Blueberry Futures emphasizes a broker‑backed infrastructure and transparent evaluation process that mirrors real market conditions. With advanced technology, notably the Blackarrow trading platform, and a suite of analytics tools intended to support trader decision making. This infrastructure is presented as a competitive advantage aimed at enhancing execution quality and risk analysis during the evaluation phase.

Blueberry Futures: Key Features

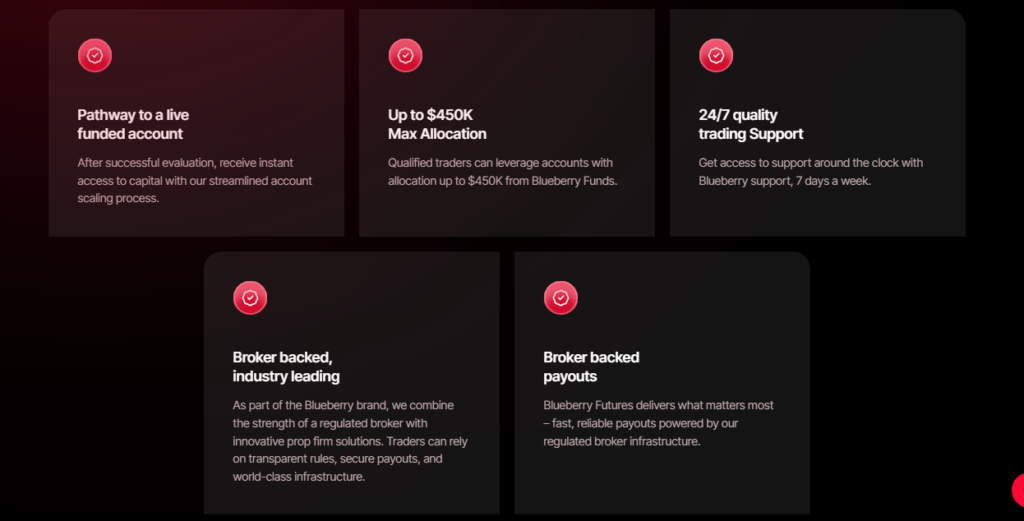

1. Streamlined Futures Evaluation and Funding PathwayBlueberry Futures centers its offering on a structured evaluation challenge that allows traders to demonstrate their skills and progress to live funded trading accounts with access to professional capital once targets are achieved. The site frames this as a clear progression from evaluation to funded account status.

2. Broker Backed Infrastructure and Payout ReliabilityThe platform is presented as part of the broader Blueberry brand, with backing from a regulated broker that supports transparent trading rules and secure, broker‑backed payouts. This integration is highlighted as a competitive advantage in terms of operational stability and capital safety.

3. Technology Stack Powered by BlackarrowBlueberry Futures integrates the Blackarrow trading platform, described on the site as a purpose‑built futures execution and analytics environment. This technology includes access to a large array of analytical tools, positioning Blueberry Futures as technologically capable within the prop firm ecosystem.

4. Comprehensive Analytical ToolsOfficial content references 100+ technical indicators, free top‑of‑book market data, and volume analysis tools within the Blackarrow platform. These features aim to support decision making during both evaluation and funded trading.

5. Globally Recognized Platform ReachThe site notes that the underlying trading platform used by Blueberry Futures is globally trusted, with adoption across over 160 countries and millions of users, positioning it as an established system within the futures trading community.

6. Tiered Evaluation Plans and Account SizesBlueberry Futures displays multiple account sizes and plan options, indicating customized routes for traders at different skill levels and trading objectives. These plans include distinct parameters such as drawdown types, profit targets, time limits, and profit splits.

7. Up to High Allocation Limits on CapitalOfficial site content highlights maximum allocation potential for qualified traders (up to substantial six‑figure capital limits), emphasizing the platform’s aim to provide meaningful scaling opportunities for high‑performance traders.

8. Around‑the‑Clock SupportBlueberry Futures asserts availability of 24/7 quality trading support, suggesting continuous assistance for traders regardless of geographic location or trading hours.

9. Community Engagement ChannelsThe presence of a community Discord server and direct links to social channels indicates that Blueberry Futures situates itself not only as an evaluation and funding platform but also as a community hub for traders.

10. Limits to Permitted Products and MarketsOfficial terms specify that participants are permitted to trade listed futures products exclusively from major exchanges such as CME, CBOT, NYMEX, and COMEX, with other asset classes (e.g., stocks, forex, crypto, and CFDs) explicitly excluded from the futures program.

Also, you may read 10 Best Futures Prop Trading Firms

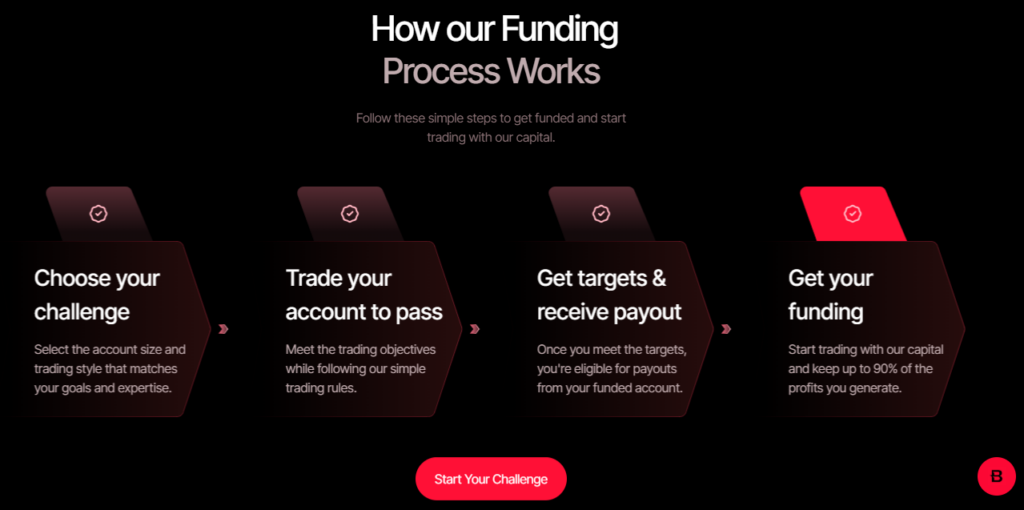

How BlueBerry Futures works: A step-by-step guide

Here’s a step-by-step explanation of how Blueberry Futures works, strictly based on official site content:

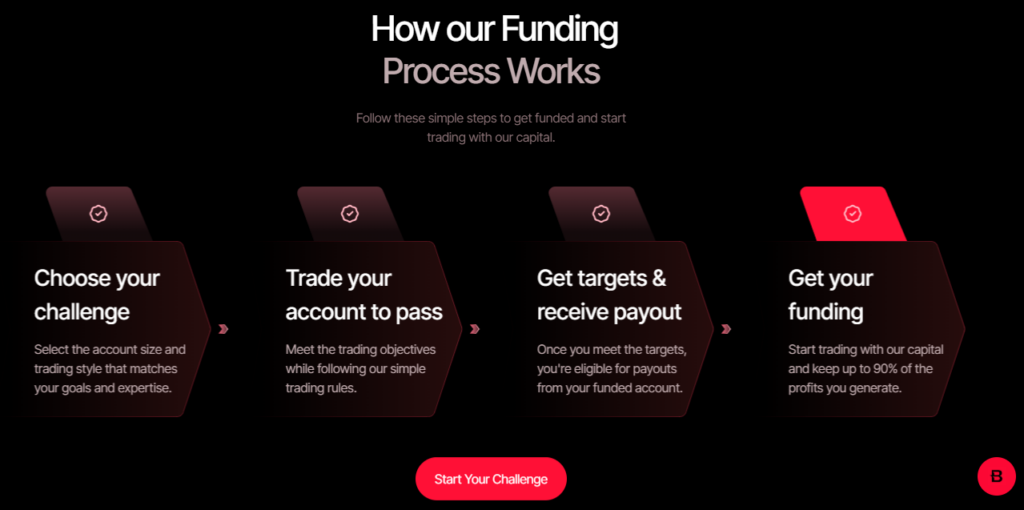

Step 1. Choose an Evaluation ChallengeTraders start by selecting an evaluation challenge that aligns with their preferred account size and trading objectives. There are different plans available, each with specific rules around drawdown limits, timeframes, profit targets, and fees. The challenge is designed to test a trader’s ability to meet these performance criteria within simulated market conditions.

Step 2. Trade in a Simulated EnvironmentOnce the evaluation challenge is selected, traders begin by trading in a simulated market environment. This allows them to demonstrate their trading skills without risking real capital. Traders must follow the rules set for the challenge, including risk management and trading restrictions.

Step 3. Meet Profit and Risk TargetsTo successfully complete the evaluation, traders need to meet profit targets while adhering to drawdown rules. These drawdown rules are typically defined either as end-of-day (EOD) limits or trailing drawdown limits. Meeting these targets proves that the trader can operate within the set risk parameters and handle live trading conditions.

Step 4. Qualify for a Funded AccountIf a trader successfully achieves the profit target and meets all risk management rules during the evaluation, they qualify for a funded account. This marks the transition from simulation to managing actual capital, giving the trader access to live market trading with real money.

Step 5. Trade Live with Funded CapitalOnce funded, traders can start trading live markets with real capital, adhering to the same risk and profit-sharing terms. The trader now operates within the risk management rules provided by Blueberry Futures while managing the firm’s capital.

Step 6. Receive Profit PayoutsTraders are eligible to receive profit payouts based on their performance in live trading. Blueberry Futures offers a profit-sharing model, where traders keep a percentage of the profits they make, as long as they adhere to the established payout thresholds and terms.

Step 7. Continue ScalingAfter proving their success, traders have the opportunity to scale their trading by accessing higher capital allocations as they continue to meet performance benchmarks. This progression allows traders to grow their trading accounts as they demonstrate consistency and risk management.

Also, you may read My Funded Futures: Review

Blueberry Futures Challenge Structure Overview

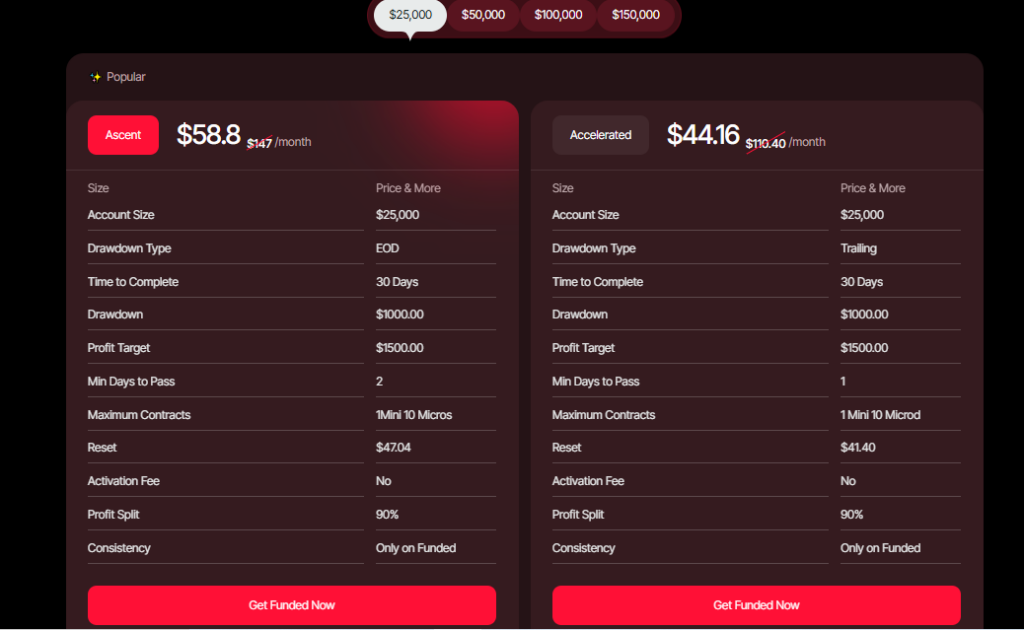

There are two types of plans to choose for trading evaluation as follows:

Ascent Plans: Ascent Plans at Blueberry Futures are structured evaluation challenges with end‑of‑day drawdown rules designed for traders targeting steady progression to funded accounts with larger capital allocations.

Accelerated Plans: Accelerated Plans at Blueberry Futures feature trailing drawdown rules and a faster pass requirement, offering an alternative route to funded trading for traders who prefer more dynamic evaluation conditions.

Ascent Plans:

Profit Split: 90%

Consistency: Only on Funded

Activation Fee: No

Time to Complete: 30 Days

Min Days to Trade: 2

Drawdown Type: EOD

Accelerated Plans

Profit Split: 90%

Consistency: Only on Funded

Activation Fee: No

Time to Complete: 30 Days

Min Days to Trade: 1

Drawdown Type: Trailing

Partnership and Affiliate Programs

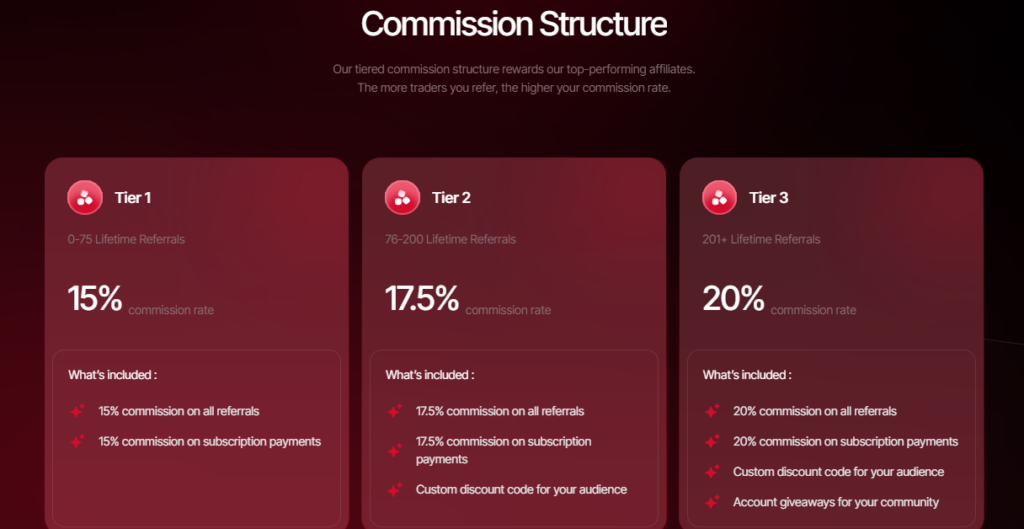

The Blueberry Futures Affiliate Program allows partners to earn commissions by referring traders to the Blueberry Futures platform. Affiliates receive a unique referral link that tracks conversions. Through this link, affiliates can promote Blueberry Futures and earn revenue when referred traders subscribe or make purchases on the platform.

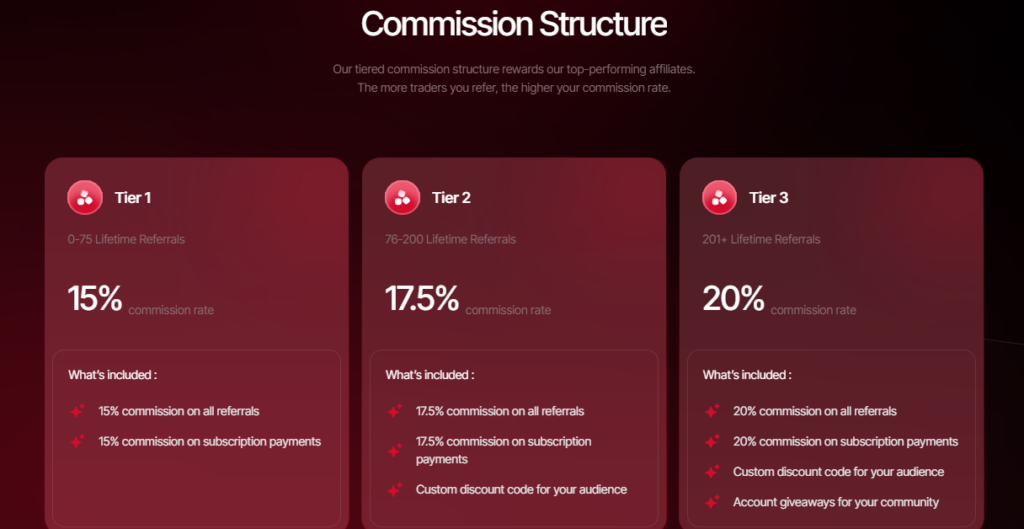

Commission StructureThe program uses a tiered commission model based on lifetime referral volume. As affiliates refer more traders over time, their commission percentage increases:

Tier 1 (0–75 lifetime referrals): 15% commission on referred purchases.

Tier 2 (76–200 lifetime referrals): 17.5% commission.

Tier 3 (201+ lifetime referrals): 20% commission.For all tiers, commissions apply both to referrals and subscription revenue associated with those referrals.

Affiliate Benefits and FeaturesAffiliates gain access to several program benefits designed to support promotion and revenue tracking:

Recurring Commissions: Earn on both initial and ongoing subscription payments from referred traders.

Comprehensive Dashboard: Track referral performance, conversions, and earnings through an affiliate portal.

Easy Payments: Affiliates can request payouts once they reach a minimum threshold (typically USD 100), with payouts processed within a specified period after request.

Marketing Resources: Partners have access to promotional materials such as banners, landing pages, and content to help increase conversions.

Custom Coupon Codes: Affiliates can provide custom discount codes to their audience that track sales and may offer additional incentives.

Also, you may read Take Profit Trader: Is it Reliable?

Blueberry Futures: Security & Safety

Futures Trading Risk: Futures trading involves significant risk, with potential to lose more than the initial investment. Past performance does not guarantee future results.

Permitted Products: Blueberry Futures only supports listed futures products on major exchanges (CME, CBOT, NYMEX, COMEX). Stocks, forex, and cryptocurrencies are not supported.

Simulated Trading: During the evaluation, traders use a simulated environment, and results may not replicate live trading outcomes.

Evaluation Challenge: The evaluation challenge is designed to be challenging, and success is not guaranteed for all traders.

Refund Policy: No refunds are provided after purchase of evaluation or membership fees.

Regulatory Status: Blueberry Futures is not registered with the SEC or CFTC and operates outside direct U.S. regulatory oversight.

Broker-Backed Infrastructure: The platform operates with broker-backed infrastructure, ensuring secure payouts and transparent trading rules.

Support and Community Ecosystem

Blueberry Futures offers 24/7 quality support to assist traders throughout their journey. Users can get help anytime through multiple channels, including live chat and email. The platform also maintains an active Discord community where traders can engage in real-time discussions. This space is ideal for peer interaction, idea-sharing, platform updates, events, promotions, and general conversations, fostering a strong sense of community.

For those seeking answers, Blueberry Futures provides a comprehensive FAQ section on its website. This resource covers key topics such as getting started, pricing, billing, trading rules, evaluation requirements, and funded account guidelines. It serves as an essential tool for quickly resolving common questions.

Additionally, the site offers detailed help center articles that explain everything from evaluation parameters and risk management rules to payout processes and troubleshooting. These articles act as a self-help resource for users to find solutions on their own.

For more specific issues, traders can use the direct contact form available on the site. This allows them to send messages to the support team for personalized responses regarding any questions or concerns.

Finally, the community and networking opportunities available through Discord and other channels encourage traders to participate in discussions, share insights, and stay updated on platform announcements. This creates a collaborative and supportive environment for traders to thrive.

Also, you may read Alpha Futures: An Overview

Conclusion

Blueberry Futures is positioned as a broker‑backed futures evaluation and funding platform that offers traders a structured pathway to demonstrate trading skill through its evaluation challenges and access professional capital up to significant allocation levels. The platform emphasizes transparent trading rules, access to advanced technology, and around‑the‑clock support, aiming to help disciplined traders build confidence and progress toward funded trading.

It is best suited for futures traders who seek a clear progression from simulated assessment to funded capital, value broker‑backed infrastructure, and are focused on regulated listed futures markets rather than other asset classes.

What types of products can I trade?

Traders on Blueberry Futures are permitted to trade listed futures products only from major exchanges such as CME, CBOT, NYMEX, and COMEX; other asset classes like stocks, forex, crypto, and CFDs are not supported.

Who is behind Blueberry Futures?

Blueberry Futures is built by the same team behind Blueberry Funded and is part of the broader Blueberry family of brands, operated by professionals with experience in futures trading, brokerage operations, risk management, and trading technology.

What is the evaluation challenge?

The evaluation challenge is a simulated trading assessment where traders must meet profit targets and risk rules to qualify for access to funded capital.