Bitcoin is once again facing critical conditions, with the price retesting the range lows near $110,000 following a volatile and uncertain weekend. After Friday’s massive crash, which wiped out billions in leveraged positions, bulls are struggling to regain control and establish a stable recovery. The broader market remains cautious, as traders weigh whether the current level can hold or if another wave of selling could push prices lower.

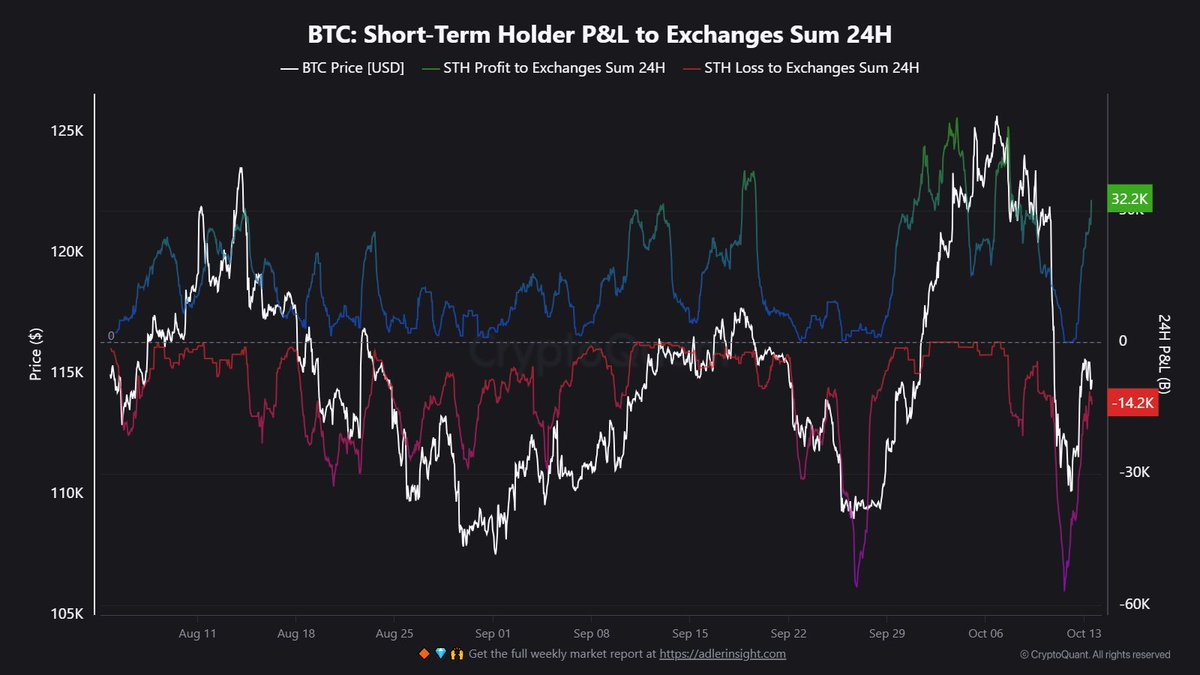

Despite the pressure, some analysts see potential signs of resilience if Bitcoin can maintain support in this zone. According to top analyst Maartunn, recent on-chain activity reveals an important shift in market behavior. Over the last 24 hours, Short-Term Holders (STHs) have sent 46,524 BTC to exchanges, signaling active repositioning after the latest downturn.

Such behavior often marks a short-term reset, allowing the market to absorb profit-taking and capitulation simultaneously. As Bitcoin hovers around key support, holding this range could determine whether the market is preparing for stabilization or another leg down.

Bitcoin Enters New Phase As Market Seeks Direction

According to Maartunn, the latest on-chain data reveals a critical rebalancing phase among Short-Term Holders (STHs) following the recent market crash. In the past 24 hours, these investors sent 46,524 BTC to exchanges, marking one of the largest movements in recent weeks. Of that total, 32,279 BTC were sent in profit, while 14,245 BTC were moved at a loss. This pattern reflects a market dynamic in which some investors are locking in gains after the latest recovery attempt, while others are cutting losses to reduce exposure amid uncertainty.

Maartunn notes that such activity is typical in the aftermath of sharp corrections. It often signals the process of cleansing excess leverage and emotional trading — an essential step toward restoring equilibrium in the market. This type of rebalancing phase usually precedes the formation of a short-term or mid-term bottom, as selling pressure from both profit-takers and panic sellers gets absorbed by stronger hands.

The coming days will be decisive in determining whether Bitcoin can stabilize near the $110,000–$112,000 range and build the foundation for a recovery. If the price holds, it could indicate that the market has found a sustainable floor, paving the way for renewed accumulation and confidence among investors. However, a breakdown below this zone could reignite fear and lead to another round of liquidations.

Bitcoin Tests Key Support as Momentum Weakens

Bitcoin is currently trading near $110,800, testing a crucial support zone after failing to hold above the $115,000–$116,000 resistance range. The 12-hour chart shows that BTC continues to struggle with downward pressure following last week’s crash, as market sentiment remains fragile and volatility persists.

The rejection from the $117,500 level — a major supply zone that has capped rallies since early September — triggered renewed selling, pushing the price back below the 50-day (blue) and 100-day (green) moving averages. This breakdown highlights weakening short-term momentum, with the 200-day MA (red) now positioned near $111,000, acting as the last significant line of defense for bulls.

If Bitcoin closes decisively below this level, it could signal a deeper correction toward $107,000–$108,000, an area of previous accumulation. On the other hand, maintaining support here could set the stage for a rebound attempt toward $114,000–$115,000, where the next resistance cluster sits.

The chart reflects a neutral-to-bearish structure, with bulls needing a strong push to reclaim lost ground. The coming sessions will be crucial, as sustained weakness below moving averages could extend the consolidation phase — while a bounce from current levels might confirm short-term stabilization before any broader recovery.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.