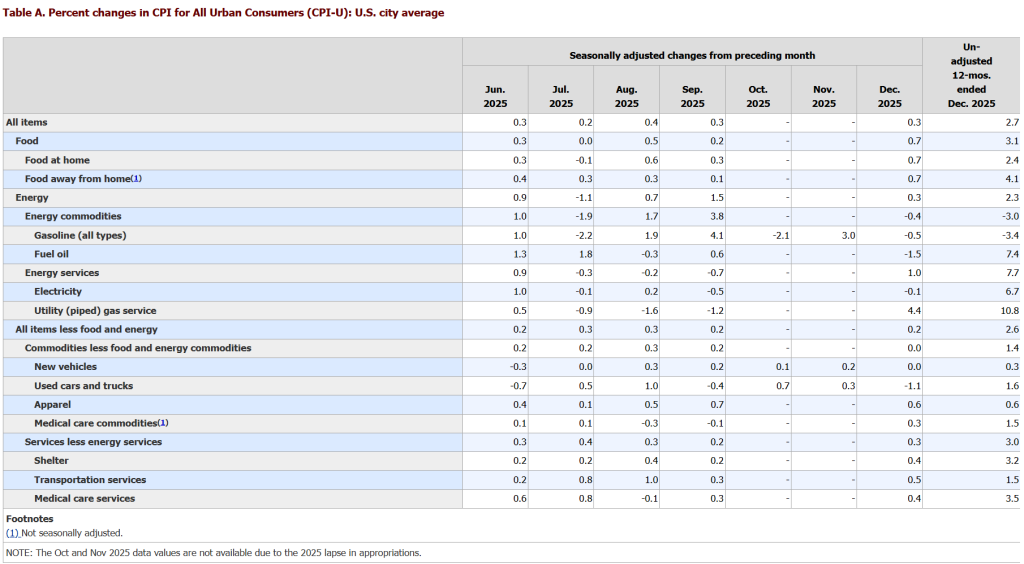

U.S. inflation re-accelerated at the margin in December as the Bureau of Labor Statistics reported that CPI-U was up 0.3% m/m and 2.7% y/y, with shelter up 0.4% m/m as the largest contributor to the monthly rise.

Bitcoin was trading at approximately $92,176.63 (+1.62% 24h) at the time of the release.

Market Reaction and Rate Outlook

Core inflation stayed contained on the headline release. BLS printed CPI ex-food & energy at 0.2% m/m and 2.6% y/y, which aligns with the market’s “Fed stays parked” base case into the Jan. 29, 2026, FOMC meeting.

“The index for shelter rose 0.4 percent in December and was the largest factor in the all items monthly increase,” according to the release.

Rate pricing remains the key transmission channel into crypto beta. Public snapshots of CME FedWatch-derived odds circulating in late December showed a rate-hold skew for January, with “no change” probabilities clustered around the high-70% range, according to KuCoin.

Vol markets signal the same macro posture. Deribit’s own documentation defines DVOL as the options-implied volatility benchmark that settles via a 60-minute TWAP.

What It Means for Crypto Markets

Shelter-led CPI keeps the term premium sticky, but core inflation at 0.2% limits the “higher-for-longer” tail risk that typically pressures BTC duration trades hardest.

A 0.3% CPI with a 0.2% core keeps the front end anchored and pushes the crypto reaction function back to real yields and positioning: systematic funds that key off macro surprise indices get no fresh signal, while discretionary desks keep running BTC as a rates-vol proxy because subdued implieds (DVOL-linked products) lower the carry cost for convexity into the Jan. 29 meeting and the Feb. 11, 2026, CPI release date that BLS already scheduled.

The post U.S. CPI Prints 0.3% in Dec; BTC Holds $92K as Rate-Hold Odds Firm appeared first on Cryptonews.